Tally GST Course in Howrah

Learn Tally GST with Hands-on Experience

Welcome to our Tally GST Course in Howrah, designed to help you master Tally and GST concepts with practical knowledge. This course is ideal for beginners and professionals looking to enhance their skills in accounting, GST, and business management. Also read out blog on tally

Course Overview

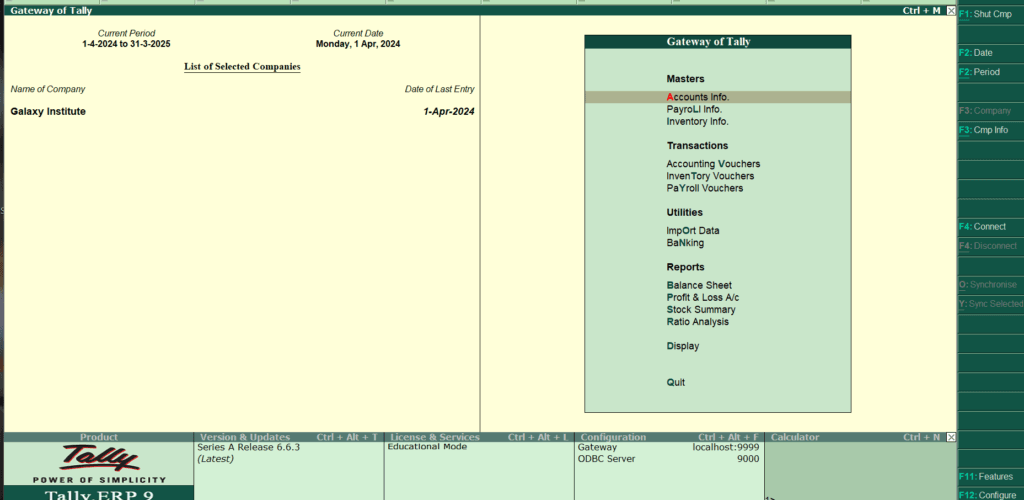

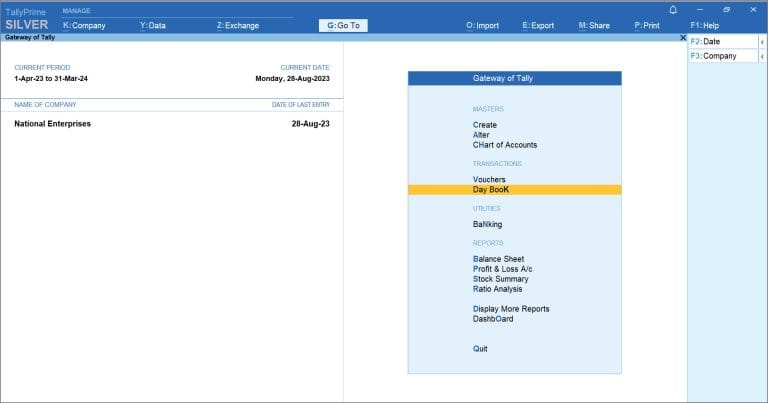

This Tally GST Course in Howrah provides comprehensive training in Tally PRIME & TALLY ERP, specifically focusing on GST-related functionalities. The course duration is 4 months, ensuring you gain practical knowledge and real-world application skills.

Key Highlights of the Tally GST Course in Howrah

- 4 Months Duration

- Hands-on Training with real business scenarios

- Expert Trainers with industry experience

- Practical Assignments and Projects

- 24/7 Access to Course Materials

- Job Assistance upon completion

Course Modules & Contents

The Tally GST course includes the following modules:

Module 1: Introduction to Tally ERP

- Overview of Tally and its functions

- Setting up the company in Tally

Module 2: Company Creation and Configuration

- Step-by-step guide to company creation

- Configuring company settings for GST

Module 3: Ledger, Group, and Inventory

- Creating and managing ledgers

- Grouping of ledgers for efficient management

- Setting up inventory for stock management

Module 4: Stock Management & Godown

- Understanding stock items and their management

- Godown management for multiple locations

Module 5: Voucher Entries

- Sales, purchase, payment, receipt, and contra voucher entries

- GST-specific voucher entries

Module 6: Bank Reconciliation Statements (BRS)

- Bank reconciliation process in Tally

- Matching and reconciling transactions

Module 7: Budget Control & Interest Calculation

- Managing budgets within Tally

- Interest calculation and its configuration

Module 8: Payroll Management

- Setting up employee records

- Calculating salaries, deductions, and generating payslips

Module 9: GST Functions

- GST Purchase & Sales Entry

- How to enter GST-related transactions in Tally

- GST Registration and its process

- GST E-Filing: How to file returns

Module 10: Financial Reports and Statements

- Generating Balance Sheet, Profit & Loss, Trial Balance

- How to customize reports for business needs

- Understanding the tax impact on financial statements

Module 11: Multi-Currency Transactions

- Setting up multi-currency in Tally

- Managing foreign currency transactions and conversions

Module 12: Cost Center and Cost Category

- Setting up cost centers and cost categories for tracking expenses

- Generating cost reports for better financial control

Module 13: Tally Data Security and Backup

- Implementing security measures to protect company data

- Taking regular backups and restoring data in case of emergency

Module 14: Tally Advanced Features

- Integration with other business applications

- Customizing Tally for specific business needs

- Automating repetitive accounting tasks

Module 15: GST Audit and Compliance

- How to perform GST audits using Tally

- Ensuring GST compliance for businesses

- Handling GST notices and disputes

Who Can Join the Tally GST Course in Howrah?

- Students aspiring to pursue a career in accounting

- Professionals looking to enhance their skills in Tally and GST

- Business owners and managers who wish to manage their accounts efficiently

- For support & help visit tally help center.

Course Fee and Enrollment

The fee for the Tally GST Course in Howrah is competitive and affordable. For more details on pricing, please contact us or visit our registration page.

Course Schedule

- Batch Start Dates: Available throughout the month

- Mode: Classroom

- Class Timings: Flexible slots available

Why Choose Our Tally GST Course in Howrah?

- Comprehensive Training: Covering every aspect of Tally and GST

- Experienced Faculty: Learn from experts with hands-on industry experience

- Practical Learning: Real-world examples and case studies

- Job Placement Assistance: Help you kickstart your career

Contact Us

For any inquiries or to get more information about the Tally GST Course in Howrah, feel free to contact us.

Phone: 9051963714

Email: info@galaxyinstitutes.in

Address: 65, chinta mani dey road, howrah-1

For more details, Visit our centre today.

Frequently Asked Questions (FAQs)

1. What is the duration of the Tally GST Course in Howrah?

The Tally GST course lasts for 4 months. This duration includes comprehensive theoretical lessons and practical training to ensure you gain hands-on experience.

2. Who can join the Tally GST Course?

The course is designed for:

- Beginners who want to learn Tally and GST from scratch.

- Working professionals who want to enhance their accounting and GST knowledge.

- Business owners and entrepreneurs who need to manage their accounts and GST filings effectively.

3. What will I learn in the Tally GST Course?

In the Tally GST Course in Howrah, you will learn:

- Tally basics including company creation, ledgers, and group management.

- Stock management, including inventory and godown setup.

- GST-specific functions, including purchase and sales entries, GST registration, and e-filing.

- Payroll management for calculating employee salaries and generating payslips.

- Advanced topics like GST audits, multi-currency transactions, and cost center management.

4. Is there any practical training included?

Yes, the course includes hands-on practical training with real-world business scenarios. You will work with live data and get an opportunity to manage GST entries, payroll, and other accounting functions in Tally.

5. What is the course fee for the Tally GST Course in Howrah?

The course fee is competitive and affordable. Please contact us directly or visit our registration page to get more details on the fee structure.

6. Do you provide any job placement assistance?

Yes, we provide job placement assistance to students upon successful completion of the course. We help you prepare for interviews and connect with job opportunities in the accounting and finance sectors.

7. Can I take the course online?

Yes, the Tally GST Course is available in both classroom and online modes. You can choose the mode that best suits your needs.

8. Do I need to have any prior knowledge of accounting to join the course?

No, prior accounting knowledge is not required. The Tally GST Course is designed for both beginners and professionals, and we will guide you through each module step by step.

9. Will I receive a certificate after completing the course?

Yes, upon successful completion of the Tally GST Course, you will receive a certificate that validates your expertise in Tally and GST.

10. What are the career opportunities after completing the course?

After completing the course, you can explore various career opportunities, such as:

- Accountant

- GST Consultant

- Payroll Manager

- Financial Analyst

- Tally Trainer

11. Can I get support after completing the course?

Yes, we provide post-course support to ensure you can apply your skills effectively in real-world scenarios. You can reach out to us for any guidance or clarifications after completion.

12. How do I enroll in the Tally GST Course?

You can easily enroll online through our registration page, or visit our institute in Howrah to enroll in person. For more details, feel free to contact us.

13. What are the class timings?

We offer flexible class timings, including weekend batches and evening sessions, to accommodate your schedule. Please contact us for more details on available slots.

14. Can I attend the course on weekends?

Yes, we offer weekend batches for working professionals and students. You can choose from weekend or weekday sessions based on your availability.

Tally GST Course in Howrah

Learn Tally GST with hands-on experience. The course is designed to cover Company Creation, GST Purchase & Sales Entry, Payroll Management, Stock Management, and more.

Course Overview

This 4-month **Tally GST Course** offers comprehensive training in Tally and GST accounting, ideal for beginners and professionals who wish to enhance their skills in accounting and business management.

Course Modules & Contents

- Module 1: Introduction to Tally ERP

- Module 2: Company Creation and Configuration

- Module 3: Ledger, Group, and Inventory

- Module 4: Stock Management & Godown

- Module 5: Voucher Entries (Sales, Purchase, Payment, Receipt, Contra)

- Module 6: Bank Reconciliation Statements (BRS)

- Module 7: Budget Control & Interest Calculation

- Module 8: Payroll Management

- Module 9: GST Functions (Purchase & Sales Entry, Registration, E-filing)

- Module 10: Financial Reports and Statements

- Module 11: Multi-Currency Transactions

- Module 12: Cost Center and Cost Category

- Module 13: Tally Data Security and Backup

- Module 14: Tally Advanced Features

- Module 15: GST Audit and Compliance

Who Can Join?

This course is suitable for:

- Students aiming to build a career in accounting

- Professionals seeking to enhance their Tally and GST skills

- Business owners and managers looking to manage accounting and GST returns effectively

Course Fee & Enrollment

The course fee is affordable. Please contact us for more details and to enroll in the course.

Enroll NowGet Updates And Stay Connected -Subscribe To Our Newsletter

Contact Information

-

Phone: 033-35673431

+91- 9051963714 - mail: info@galaxyinstitutes.in

-

Address: 65, Chinta mani dey road,

Ground floor, Howrah-1

Landmark- Howrah Maidan Metro

Copyright@Galaxy Institute 2025